Leverage Your Cash Flow More Effectively

Working capital management has an important role to play in the success of any business enterprise, especially during COVID-19 where it is even more vital. Over 75% of companies that are running at loss or struggling financially would be profitable and liquid if they were more disposed to the knowledge and practice of efficient working capital management. The working capital management system helps in ensuring that tied down capital that could otherwise be put to productive uses are released.

Businesses are both buyers and suppliers at different points in the value chain, so it important to understand and support each other’s needs.

Discover Frictionless Procure-to-Pay

Through integrating your credit card supplier and SAP Ariba you can achieve the next evolution in payments and procurement, delivering a simple and seamless end-to-end process for buyers and suppliers.

Combining the benefits of card payments for buyers, such as improved working capital, with the cost-effectiveness of bank transfers for suppliers – means everyone along the payment chain can benefit.

Corporate Payments: A Balancing Act

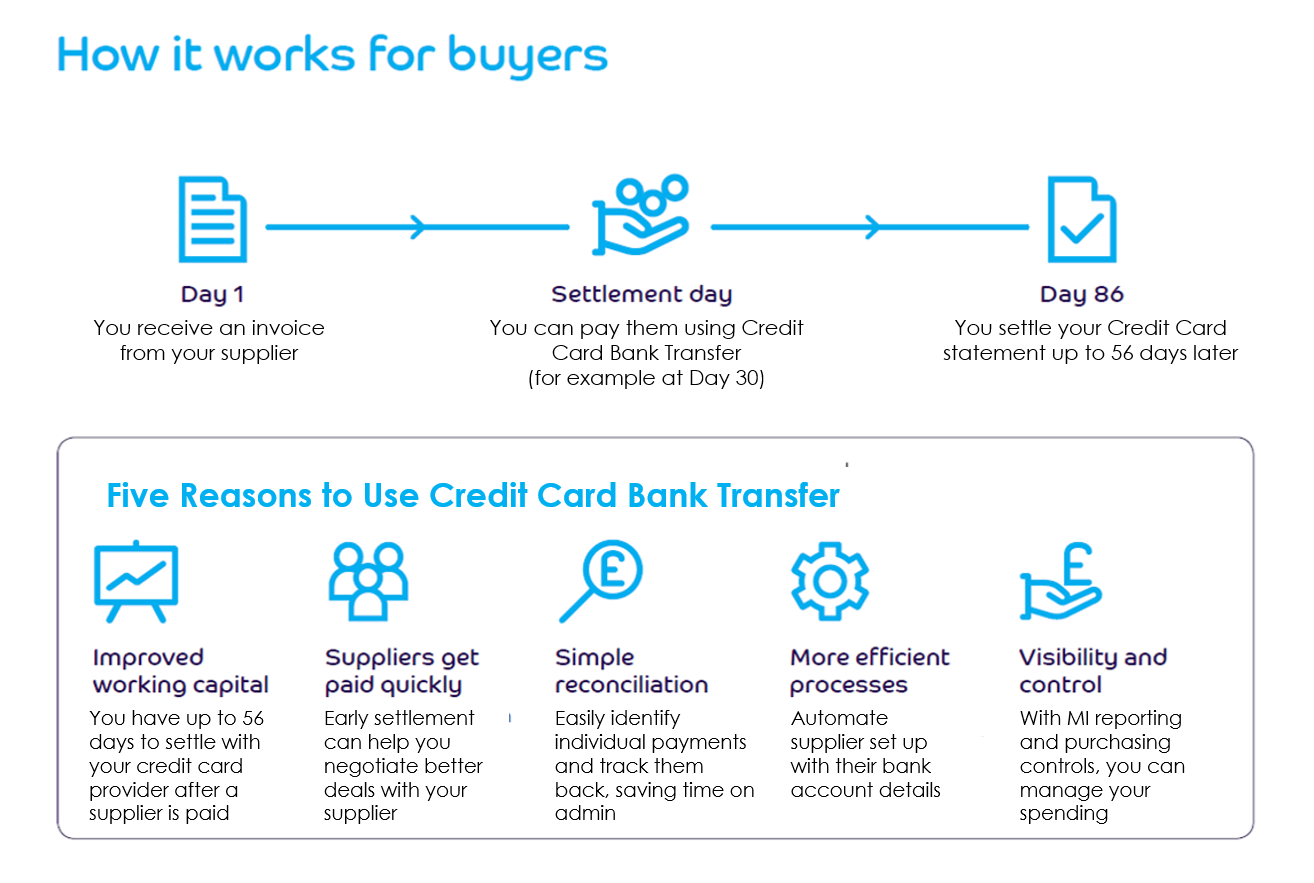

Buyers want the flexibility of using an accessible credit limit to maximise working capital and a simple friction-less payment process. Suppliers want prompt payments, via a cost-effective bank transfer rather than a card payment. Combining the benefits of both, making payments easier and helping suppliers receive money with improved terms.

With a simple and seamless end-to-end process, there’s no need to leave the Ariba Network to complete a payment; eliminating added friction from your procurement process, making tracking and reconciling payments more intuitive.

On-time Supplier Payments, Plus Extended Payment Terms For You

Deliver on-time supplier payments (at term or early via discounting), but benefit from extended settlement terms to your card provider through the usual card settlement billing cycle.

Example payment timeline

A supplier invoice is received on day 1 on 60-day payment terms. Once this is approved the buyer can then initiate a quick and easy bank transfer on day 30. The buyer will then benefit from an average of 43 days (in some cases up to 58 days) extended settlement. So the supplier is happy they’ve been paid early, while the buyer is left with more working capital without the stress of being chased for payment.

Let’s talk

For more information on how we can help your organisation addressing any supply chain disruption, contact our team today.